Who’s afraid of the WTO?

The World Trade Organisation represents the interests of the capitalist class and is a product of the lessons they have learned for protecting their system.

The World Trade Organisation is not to blame. Capitalism is. Although the WTO has emblazoned itself in everyone’s consciousness as the unacceptable face of globalisation – indeed as the secretive cabal directing the insidious movements of world finance – what it really represents is a trend as old as capitalism itself, and the continuation of old policies under a new name.

Capitalists are not oblivious to their own interest in preventing their system crumbling. The WTO and its associated world infrastructure is directly related to lessons they have learnt throughout the history of wars and disasters that the market has inflicted on the human race in the past century.

In the 1930s, national governments relied on the free trade in gold to regulate the relative value of their currencies, and structure international transactions. Capitalism’s tendency towards disharmonious movement and uneven economic growth meant that gold tended to concentrate into the hands of a handful of states (America possessed up to 60 percent of the world’s monetary gold at one point), leaving others (such as Germany) desperately short of the means of international trade. This imbalance in trading power led directly to the conditions which prompted the second world war, and devastated almost the entire continent of Europe.

Determined to avoid this situation happening again, the dominant capitalist powers met after the war, to construct an effective international machinery to enable trade to progress between states smoothly. The Bretton-Woods agreement, as devised largely by J M Keynes, sought to regulate international capital movements.

Likewise, the International Monetary Fund and the World Bank were created to ensure nations avoided suffering the same bankruptcy as Germany effectively endured in the 1920s. It was envisaged that these institutions would be joined by an International Trade Organisation, to lay-down the rules by which trade would be governed. This institution was, however, vetoed by the US at the Havana conference in 1947.

Unworkable system

What stood in place of the IT0 was the General Agreement on Tariffs and Trade, which came into force in 1948, and was based on the unobjectionable sections of the Havana Charter. Over time, GATT proved to be unworkable, with inadequate enforcement procedures, unclear rules and the rigidities of consensual agreement systems.

Thus, at the Uruguay round of GATT negotiations which ended in 1993, the World Trade Organisation was agreed upon, as a “superior” successor. The Uruguay round significantly expanded the scope of the international agreement’s remits, bringing agriculture, services and intellectual property within its field of competence, as well as seriously reducing tariffs and other protective measures allowed. This lead to an almost immediate increase in the volume of international transactions: according to the Eurostat Yearbook 2000 external investment by European Union states increased by almost 500 percent from 1995 -1999.

This is simply part of an on-going trend within the development of the market system. As trade progresses, so too does standardisation of the rules and groundwork. In the early nineteenth century England, for example, a merchant would have had to know how to reconcile his Durham pecks with his Dorset grains and his Norfolk drams, when selling goods by weight. Likewise, each town would have its own time (relative to its distance in minutes from Greenwich). These times and weights formed the legal framework for trade in each of these districts, and formed a burdensome cost to any business trying to operate across them.

In time, the need to concentrate capital, and increase the area and scope of the circulation of commodities meant that such discrepancies between local authorities were overcome. Usually, this meant over-ruling them through the authority of the centralised state, and enforcing a uniform set of rules across the whole economic zone. This tendency for the concentration of capital continues, and the same problem manifests itself in differences of trade regulations between nation-states, although this time there is no central authority powerful enough to completely over-rule them and impose its standards.

The reasons for the increasing concentration of capital lie, essentially, in the methods by which labour is exploited by capital. When a commodity is produced the capitalist calculates its cost of production (the cost of goods that went into it, plus labour), and then adds a profit mark up roughly in line with the expected rate of profit of their rivals. This average rate of profit applies regardless of the amount of value added by the specific production process involved, but, rather, the total value added across the whole economy.

What this means is that industries which involve a large input by labour (ie, which add a lot of value) lose out because the average profit mark-up is less than the value they add. This means that this added value is transferred into the profits of industries which are less labour intensive. It is, therefore a competitive advantage for capitalists to increase the ratio of productive capital to labour (known as the organic composition of capital). With this increase comes an extension of the productive capacity in an industry, with capacity being taken up by fewer and fewer production units.

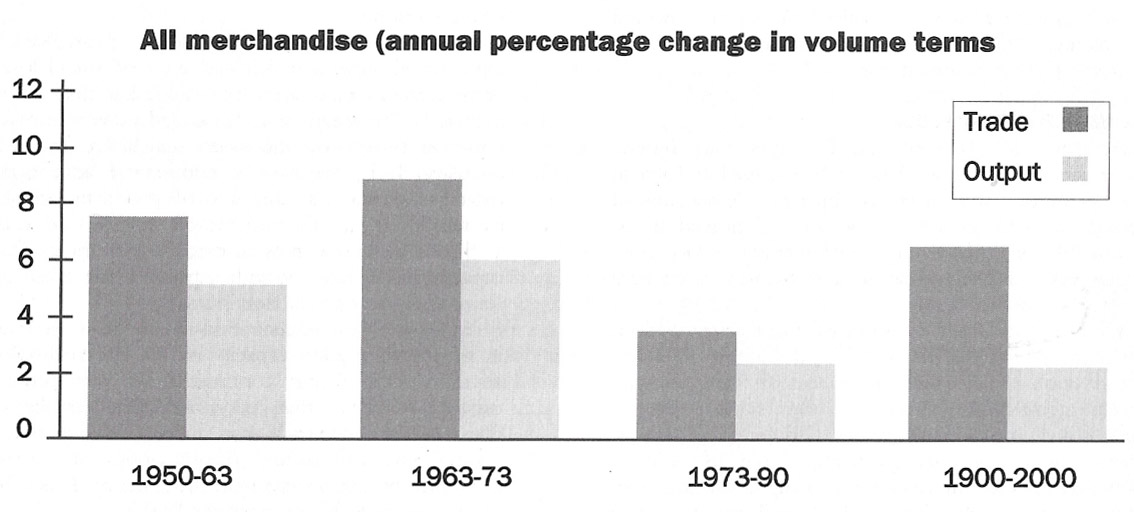

Alongside this concentration of capital is the increase in the transportation capacity of society. Technological advances in transport continue apace with productive capacity, meaning that, in general, the circulation of commodities and trade can increase faster than the productivity of society (more goods to transport multiplied by a faster rate of moving them). This is born out by the chart below from the WTO

In each period the rate of increase in trade is greater than the rate of increase in output of merchandise. One of the most significant details, however, if the massive increase in trade in 1990-2000, in a period in which merchandise output actually fell compared to the previous period. The effects of the inauguration of the WTO can be seen in this increase. It is an increase in excess of the usual growth in trade, and thus represents an exceptional occurrence.

The motivation for this spurt in trade may well lie in the observable decline in productive output across the whole chart. The rate of output growth is under half that of 1963-1973. Capitalists, misled by theories which see value as being created rather than realised by trade, treat trade as a good in itself, and think that by increasing the circulation of goods they will be able to dig themselves out of the profitability hole indicated by the drop in output growth. Alongside this is the temptation to exploit the differences in national and regional rates of profit to try and realise an exceptionally high profit.

What this means is, effectively, that through increased trade capitalists are attempting to rip each other off, as a result of their incapacity to exploit the workers enough. Through increasing trade competition, they are effectively increasing the scramble for a share of the total global production of surplus value. This can also be seen in the increase in currency speculation and finance capital movements around the world. Since these forms of activities are entirely unproductive they represent a mere redistribution of booty among the thieves.

This tendency can also be observed in the decision to open up services to international competition. Although British ministers maintain fervently that this does not mean the WTO will force privatisations upon countries, the fact is that International Monetary Fund (IMF) structural adjustment programmes usually force countries to attempt to decrease the size of their state sector, paving the way for firms from advanced capitalist countries to take over these services and sweat profits out of the workers there. It represents another way of opening up otherwise marginalised sources of surplus value to be taken back to the industrialised core.

Backwardness

Vast areas of the world, the “post-colonial” zones are still dedicated to low value yielding primary products such as mono-crop agriculture and mining. Most of the increased trade remains between the industrialised manufacturing centres. The top five exporting states (EU, US, Japan, Canada, China) represent 53.2 percent of the world export market (according to WTO figures), whereas the top four importers take a 54 percent share between each other. The EU and the US both import considerably more than they export, and represent a substantial lucrative market to access.

This imbalance of trade between the core and the periphery indicates the way in which the idea that opening up free trade will benefit poor nations and assist in their development is flawed. The sheer economic clout of the big capitalist states means they can bully and force other states into letting them have their way. As George Monbiot noted in his Guardian column (6 November) one WTO delegate from a poor state saying “If I speak out too strongly, the U.S. will phone my minister. They will twist the story and say that I am embarrassing the United States. My Government will not even ask, ‘What did he say?’ they would just send me a ticket tomorrow”.

Such raw power means that whatever formal equality of the rules, they will still be used to serve the ends of the dominant states. Each national capitalist class seeks to protect its position and its investments, and is exceedingly unwilling to relinquish control of the state force which props up its power. The dominant policy is currently to pursue mutual capital interpenetration, and thus prevent losing control of their national economy at home, whilst having sufficient hostage capital to deter expropriation abroad. Whilst the times are good this policy is tolerable, but come a time of crisis each group will seek to save their own skins first and foremost. Should America sink into deep recession, it may decide to put a stop to the raiders taking a share of its profits, and throw the barriers back up.

Certainly, so long as world society depends first and foremost upon competing capitalist groups vying for profits, it will be subject to the anarchy of capitalist self-interest, and any world body will be subordinated to the Machiavellian manoeuvrings of these groups. So long as capitalism remains any world body will be used as a potential tool for exploitation and robbery. The only genuine way to move forward to a world human community is by the abolition of sectional national élite interest, and the creation of a world human interest of common ownership of the worlds wealth, so that we can end the horrendous divisions the property system has created.

Certainly, so long as world society depends first and foremost upon competing capitalist groups vying for profits, it will be subject to the anarchy of capitalist self-interest, and any world body will be subordinated to the Machiavellian manoeuvrings of these groups. So long as capitalism remains any world body will be used as a potential tool for exploitation and robbery. The only genuine way to move forward to a world human community is by the abolition of sectional national élite interest, and the creation of a world human interest of common ownership of the worlds wealth, so that we can end the horrendous divisions the property system has created.

PIK SMEET